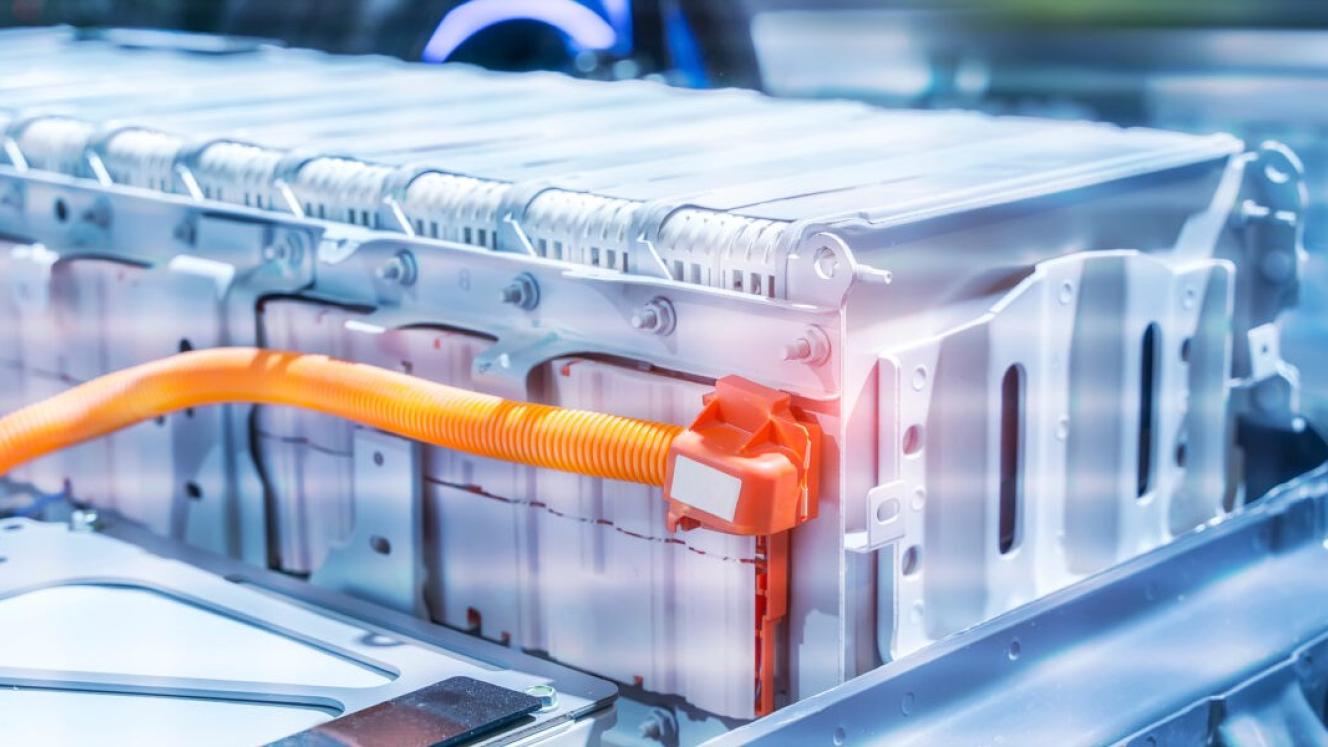

“The battery industry is entering a new phase of its development,” says the International Energy Agency (IEA) in new analysis noting record-breaking deployment, falling prices and shifting global production dynamics. In 2024, annual battery demand exceeded 1 TWh for the first time, driven by a 25% rise in electric vehicle (EV) sales, analysts say.

At the same time, the average battery pack cost for an EV fell below US$100 per kWh – a widely recognised industry threshold for cost competitiveness with internal combustion engines. “The global battery market is advancing rapidly as demand rises sharply and prices continue to decline,” IEA analysts say.

Lower battery prices could expand the deployment of utility-scale and behind-the-meter storage systems, enhancing industrial microgrids, peak-shaving solutions and renewable energy integration. The IEA identifies three key drivers of falling battery costs:

- Lithium price collapse – Lithium prices have dropped by more than 85% from their peak in 2022, dramatically lowering the cost of battery materials.

- Increased manufacturing capacity – Global battery manufacturing capacity reached 3 TWh in 2024 and the next five years could see another tripling of production capacity if all announced projects are built.

- Supply chain integration – China’s control over the entire battery supply chain, from mining and refining to production, has allowed manufacturers to reduce costs and scale up rapidly.

LFP battery adoption grows

Lithium iron phosphate (LFP) batteries have seen explosive growth, tripling their market share in five years and now accounting for nearly half of global EV batteries. Initially dismissed due to lower energy density, LFP technology has become the preferred choice in several applications due to its affordability and safety benefits. “Today, LFP batteries are about 30% less expensive than their main competitor, lithium nickel cobalt manganese oxide batteries, while still offering competitive ranges for EVs,” analysts say.

For industrial energy storage applications, LFP’s longer lifespan, lower cost and greater thermal stability make it an increasingly attractive option for utilities, mining operations and commercial-scale energy storage systems.

China’s market dominance

China remains the largest global battery producer, responsible for over 75% of total output. The IEA attributes this dominance to experience and scale. “Over 70% of all EV batteries ever manufactured were produced in China, creating extensive manufacturing know-how,” analysts say.

Vertical integration is also a factor. “The Chinese battery ecosystem covers all steps of the supply chain, from mineral mining and refining to the production of battery manufacturing equipment, precursors and other components, as well as the final production of batteries and EVs.”

However, intense domestic competition and shrinking profit margins could soon reshape the market. “The number of companies producing batteries in China is likely to fall and certain producers will acquire greater influence and pricing power,” analysts warn.

Global battery production

While China remains dominant, battery manufacturing is expanding in other regions:

- In the US, battery manufacturing capacity has doubled since 2022 following the implementation of tax credits for producers, reaching over 200 GWh in 2024 with another 700 GWh under construction.

- Europe faces higher production costs and weaker supply chains, making it difficult to compete with Asian manufacturers. “The bankruptcy of Northvolt – Europe’s largest battery startup – underscores the difficulties of competing with Asian producers,” analysts say.

- Southeast Asia and Morocco are emerging as potential production hubs for batteries and their components. Morocco’s phosphate reserves, critical for LFP batteries, have attracted investment. Meanwhile, Indonesia, the world’s largest nickel producer, has begun local EV battery production.