Players in the renewable energy industry and some media have welcomed President Ramaphosa's announcement that tax incentives for people who install PV solar to provide their own power could become a reality.

Dom Wills, the CEO of The SOLA Group, says that the state of the nation address showed the President’s intention to raise the stakes in handling the electricity crisis by dedicating more resources and removing obstacles to progress energy production. "I'm hopeful that the acceleration of energy projects could mean much needed less red tape for connecting new plants", Wills says.

But, he added, he is less positive about the effect that another minister working with the Eskom board would have. "The Eskom energy availability factor is low for a number of technical and commercial reasons which Eskom has been working on intensively since Andre de Ruyter took over", he added.

Tax breaks for rooftop solar and loans to small businesses are very welcome. A large roll out of rooftop solar installations could massively reduce the current load shedding requirement, he concluded.

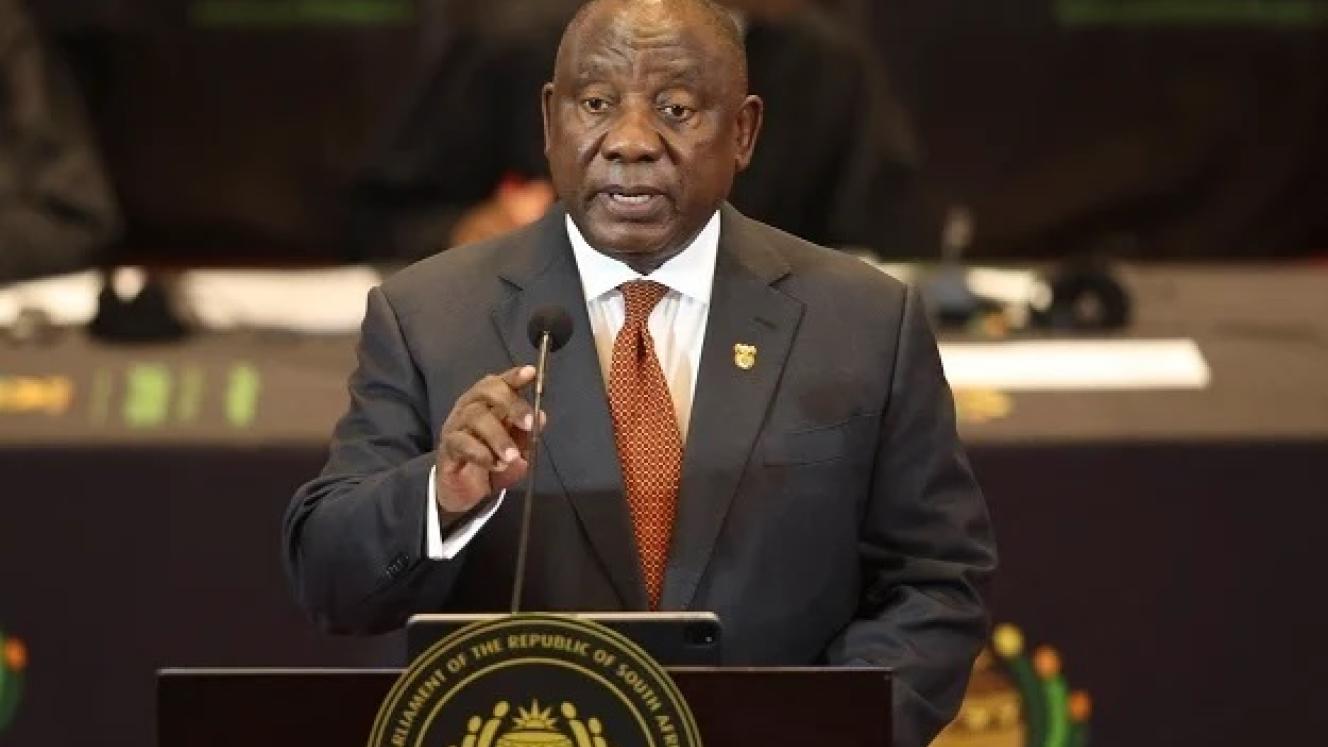

"As indicated in July last year, and with a view to addressing the load shedding crisis, we are going to proceed with the rollout of rooftop solar panels.

In his Budget Speech, the Minister of Finance will outline how households will be assisted and how businesses will be able to benefit from a tax incentive. National Treasury is working on adjustments to the bounce-back loan scheme to help small businesses invest in solar equipment, and to allow banks and development finance institutions to borrow directly from the scheme to facilitate the leasing of solar panels to their customers." - President Ramaphosa

Business Maverick's Ed Stoddard says that Ramaphosa’s tax incentives are a ray of light for a solar panel roll-out to ease SA’s energy crisis. It’s a win-win for all involved, Stoddard says. Businesses and households need to free themselves from the curse of Eskom, and the rise in productivity levels that comes with reliable energy will more than compensate the Treasury for the tax breaks that are looming.