by Klaus-Dieter Borchardt, Oxford Institute for Energy Studies

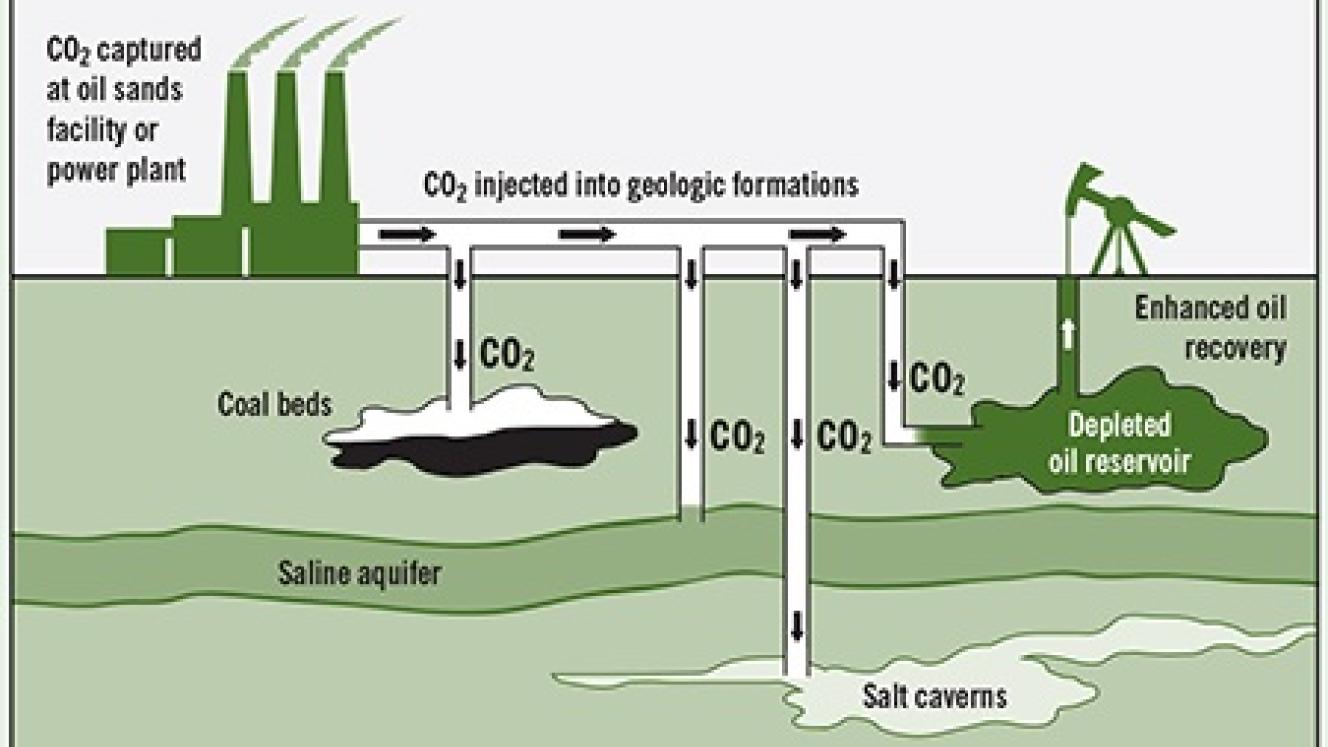

Nowadays, there is a growing focus on carbon capture, use and storage (CCUS) in the European Union (EU) in the context of reaching its targets set out in the EU Climate Law. According to modelling by the Commission and the International Panel on Climate Change (IPCC), in order to meet its climate objectives, the EU will need to capture and store at least 450 Mt/y of CO2, including direct air capture as well as industrial CO2, by 2050 [1].

Indeed, the IPCC2 in its recent report, made clear that carbon capture and storage is a critical decarbonisation strategy in most mitigation pathways. Until recently, aside from financing a handful of CCUS projects under the ETS Innovation Fund, the Commission has taken a rather passive role on this technology compared to others, arguing that the ETS alone should drive the decarbonisation development plan. However, a number of recent actions demonstrate an important political change in direction in recent months: the Commission has upscaled the CCUS Forum and has committed to accelerate the work on CCUS at EU level. It has further highlighted the need to create an internal market for CCUS and has committed to adopting – similar to the Hydrogen Strategy – a CCUS Strategy before the end of 2023 that will accelerate the development of CCUS.

To answer the question whether CCUS will become the new driver of the EU decarbonisation plan this article first will look at the key political and economic drivers for CCUS, then consider the current and upcoming regulatory framework for the capture, transport and storage of CO2 and, finally, highlight the funding of CCUS projects at EU and national level.

Key political and economic drivers for CCUS

Several indicators have been pointing towards a momentum for CCUS; these include both policy and market drivers. The rising price of the ETS allowances along with recent legislative developments have showcased an increased interest in CCUS.

Political drivers: recognition of CCUS

As already indicated, the Commission appears now to have taken an active approach regarding CCUS aiming to become a global leader. According to the Commission's President, ‘to become climate neutral, [the EU] needs to industrially store around 300 million tonnes of CO₂ annually by 2050’. The Commission proposal for a ‘Net Zero Industry Act’ sets an annual injection capacity of at least 50 million tonnes of CO₂ by 2030 in the EU. Furthermore, the potential transport of millions of tonnes of CO₂ across the EU requires a reliable, non-discriminatory, open-access and Europe-wide transport network. However, the Commission acknowledges that the EU does not have a dedicated regulatory environment for CO2 transport and storage infrastructure and considers that leaving this framework to member states alone risks creating a fragmented market, with national regulations entrenching suboptimal investments and solutions, which will prevent the creation of a single European market. Therefore, the Commission is planning to table a strategy aiming to ‘create a market, including

European technology suppliers, for CCS, CCU and carbon removal value chains.’

In this context, the Commission has already taken two important steps:

- Established the CCUS Forum, bringing together representatives from the EU institutions, EU and third countries, NGOs, business leaders and academia to facilitate the deployment of CCUS technologies. The CCUS Forum has prepared and transmitted to the Commission two papers to consider in its policy work on the CCUS Communication: first, a ‘Vision for CCUS in the EU’, emphasising the importance of CCUS technologies for achieving the EU climate targets and outlining clear actions the Commission should take to promote their implementation and second, a paper titled ‘Towards a European cross-border CO2 transport and storage infrastructure’, which underlines that developing CO2 transport and storage must be robust, transboundary and open for non-discriminatory access.

- Commissioned a study from The Energy Transition Expertise Centre (EnTEC) to analyse options for a regulatory framework supporting the development of the CO2 transport and storage infrastructure as well as business models.

Economic drivers

The Commission’s recognition of the need to develop CCUS also stems from an economic imperative which is driven by three factors: (1) the reformed carbon pricing schemes and the rising price of carbon on the ETS, (2) the taxonomy and (3) the Net-Zero Industry Act.

The reformed carbon pricing schemes and the rising price of ETS.

Recently, the price of emissions allowances in Europe (ETS price) has been highly volatile. In 2022, the emissions allowances price varied from less than €60 per tonne to more than €95 per tonne.

However, the average ETS price is trending in an upward direction. Ariadne, 2022 [3] reported a number of price projection for EU carbon allowances for 2030 from six models, five of which yield a price estimate in the range of approximately €130 to €160. This implies that a significant share of the costs for CCS can be covered by the ETS carbon price, in particular for the low-cost options. Therefore, as long as the ETS price continues to trend upwards, the greatest impact towards 2030 will be the EU's planned decrease in allowances and the introduction of the carbon adjustment mechanism.

Under the recently adopted reform of the Emissions Trading System (ETS) [4], in combination with the Carbon Border Adjustment Mechanism (CBAM) [5], emissions by energy intensive industries will progressively be fully exposed to the ETS via the elimination of free allowances and will therefore, for the first time, feel the effect of carbon pricing.

In the absence of ready access to cost-effective CO2 transport and storage, many companies will have no reasonable option to decarbonise, and will simply have to purchase ETS allowances, thus increasing costs with no climate benefit and weakening companies' financial capability to decarbonise.

Through CBAM, importers will pay a financial adjustment from 2026, buying carbon certificates corresponding to the carbon price that would have been paid had the goods been produced under the EU's carbon pricing rules. This is to prevent the import of high emitting goods at a lower price than the decarbonised goods being produced within Europe under the ETS.

Thus, by the second part of this decade (when the ETS reforms will really start to enter fully into effect for energy-intensive industries), EU industry will need to decarbonise or pay the associated penalties, and therefore if a CCS grid and storage is not available for these companies, the ETS will only act as a production 'tax' and will not deliver significant GHG savings in a sustainable way.

As a result, CCUS is the only competitive option for many such companies to decarbonise at scale in the coming years, and as a consequence, there will be a rapid and important demand for CO2 transport and storage. Without non-discriminatory and cost-effective access to a CO2 grid and storage, such companies will suffer a strong competitive handicap over the coming years. This 'demand push' will further be exacerbated by the recently adopted EU measures on corporate sustainability that will effectively require large companies to adopt a 'Paris compatible' strategy and implement it [6].

To this end, the ETS Directive, as recently amended, clarifies and improves the treatment of CCUS as follows:

- As regards CCS, the reformed ETS has clarified that GHG emissions (and, in particular, CO2) are accounted for where the transport of such gases to the ultimate storage place occurs by all means of transport (pipelines, trucks and ships). Under the previous law, GHG emissions (and, in particular, CO2) were only accounted for where the transport of such gases to the ultimate storage place occurred by pipeline. This extension has been introduced for reasons of equal treatment of the different modes of transport and means that the GHG emissions related to all possible CO2 transport methods will not be counted as having been emitted by the installation from where the transport has been initiated to the ultimate storage place.

- As regards CCU, the reform lays down that captured CO2 that is permanently chemically bound and not expected to ever be released into the atmosphere will not count as having been emitted for the purposes of ETS1.

Taxonomy

Besides ETS, the EU Taxonomy [7], a classification system defining which projects are sustainable and directing investment toward these projects, also creates a favourable environment for CCUS. The EU Taxonomy sets carbon intensity thresholds for cement, steel, chemicals, hydrogen and natural gas. CCUS will become attractive to investors if a project developer can demonstrate that the integration of CCUS can bring their carbon intensity to below the taxonomy’s standard. For example, the proposed emissions norm for newly built gas-fired power plants can only be met through the application of CCUS.

The proposal for a Net Zero Industry Act

On 16 March 2023, the Commission published its proposal on the Net-Zero Industry Act (NZIA) [8]. This proposal aims to respond to the US Inflation Reduction Act (IRA), which has transformed the investment landscape for Green Deal technologies in the US. The proposed NZIA marks a major change in the approach that the Commission has taken regarding CCUS to-date. This instrument, if adopted, will constitute a major acceleration in driving investment for the large-scale deployment of CCUS projects.

CCUS is listed as one of the key technologies for the green transition in the Commission’s Net-Zero Industry Act and includes an EU-wide target to capture CO2, with a legally binding objective of reaching an annual injection capacity of at least 50 million tonnes of CO2 by 2030. The proposed Regulation defines a number of technologies as 'Net-Zero technologies' (which includes CCUS). The manufacture of these technologies must benefit from certain limited regulatory benefits at member-state level, such as accelerated permitting.

It further defines a category of 'Strategic Net-Zero technologies' (which includes CCS technologies, but not CCU). A concrete investment project may request recognition as a Net-Zero Strategic project by a member state, in which case it benefits from limited additional regulatory benefits, plus a possible advantage in public tenders and support schemes.

For a CO2 storage project to be recognised as a 'net-zero strategic project', it must meet the following cumulative criteria:

- it must be located in the territory of the Union, its exclusive economic zones or on its continental shelf within the meaning of the United Nations Convention on the Law of the Sea (UNCLOS)

- it must contribute to reaching the CO2 injection objective, and

- it must have applied for a permit for geological storage of CO2 in accordance with CCS Directive.

The need for regional cooperation on CCS is obvious: some member states possess the potential to store CO2, many others do not and will need access. Developing CO2 networks through common, open-access infrastructure is critical to ensure European industries can decarbonise their production processes with low additional cost to consumers. The NZIA proposal therefore recognises that a cross-border, single-market approach is needed to ensure CCS can be an effective solution for industries in all member states.

To this end, Article 18 sets out certain requirements for member states:

- to publish ‘areas where CO2 storage sites can be permitted on their territory’. This is an important measure, since creating a European CO2 Storage Atlas, mapping all areas with suitable geology to store CO2, will be absolutely crucial to enable the scale up of CO2 storage sites

- within 6 months of the NZIA being implemented, to provide an update to the Commission on the status of CO2 capture and storage project developments, as well as measures taken to support their development.

Finally, it foresees an obligation for fossil fuel companies that have produced oil and gas in the EU between 2020-2023 to invest collectively to achieve an annual CO2 storage capacity of at least 50 Mt CO2 by 2030 in storage sites located in the territory of the European Union. This territorial limitation means that, notably, the large storage facilities in Norway and the United Kingdom are not covered by the proposal; Norway might be covered at a later stage if the regulation is declared relevant for the European Economic Area and its application is accepted for this area. The draft Regulation proposes to impose a direct investment obligation on these companies, pro-rata depending on their percentage of total oil and gas produced in the EU during these three years. For example, if the methodology established that company A had produced 10% of the oil and gas produced in the EU during this year, that company would have a legal obligation to ensure investment in 5 Mt of CO2 storage capacity in the EU by 2030.

Whilst by no means unique in placing direct legal obligations on companies, such a direct requirement to achieve specific investments by a given date represents an innovative legal measure at EU level and is clearly motivated by the 'producer pays' principle.

The current and upcoming regulatory framework

A well-designed regulatory framework is essential for investment as it will provide legal certainty. Given that CCUS-related investment will require billions of Euros, it is crucial to establish a predictable and long-term framework for investors, and notably the future regulatory model that will apply to such infrastructure investment.

Key regulatory aspects of the CCS Directive

The geological storage of CO2 is currently regulated by Directive 2009/31/EC9 on the geological storage of CO2 (‘the CCS Directive’), which sets out the requirements for safe and secure storage. According to the Directive, member states retain the right to determine the areas within their territory from which storage sites may be selected. member states also have the right not to allow storage on their territory at all (or to give priority to any other use of the subsurface).

The CCS Storage Directive includes provisions on site selection and characterisation, conditions for

permitting, the monitoring and reporting requirements to verify storage, as well as some requirements on providing third-party access to infrastructure. As regards permitting, the CCS Directive prescribes a permit regime for storage, which contains rights and obligations for the permit holder. However, the capture and transport phases of CCS are considered only peripherally by the CCS Directive; therefore, the development of an overarching regulatory framework for CO2 transport will be needed.

Enhanced regulatory framework

As already mentioned above, the creation of a regulatory framework supporting the development of the CO2 transport and storage infrastructure, as well as business models, is of paramount importance.

The following elements are considered by the CCUS Forum as being essential parts of this new regulatory framework which will replace in full or at least in part the currently applicable CCS Directive.

- Targets for the EU and its member states should be set in terms of storage capacity, transport infrastructure and amounts stored or utilised up to 2050. The CCUS Forum proposed that the target for storage capacity should be a minimum of 80 Mt of CO2 per year by 2030, increasing to 300 Mt by 2040 and to reach at least 500 Mt by 2050.

- It is further necessary to establish streamlined and efficient permitting processes for CCUS projects. This involves clear guidelines, standardised procedures, and coordination among relevant authorities. The NZIA proposal is definitely a right first step in this direction.

- Similar to the development of a hydrogen backbone, a predictable and transparent regulatory framework for the future CO2 transport infrastructure should be developed ensuring third-party access and including a CO2 infrastructure network operator, network planning and regional cooperation.

- In addition, it is important to ensure market access. Companies need to be able to freely enter the market and access the transport and storage services. This is already supported in current EU legislation, with the requirement from the CCS Directive which ensures third party access but needs to be further developed.

- The ‘chicken and egg’ problem needs to be solved. Transport and storage developers do not want to invest in developing transport and storage infrastructure without firstly having emitters committed to supplying CO2, whereas emitters do not wish to invest in capture technology without the required transport and storage infrastructure being already in place. The first step to solving this barrier for the widespread deployment of CCUS is stimulating initial overcapacity in transport and storage facilities and ensuring there are public mechanisms and/or public support in place for early mover projects to initially oversize their transport and storage infrastructure. This will allow for better access to the infrastructure for emitters interested in CCUS as an option to decarbonise in the future.

- Moreover, there is a general consensus on the need for further regulatory guidance on CO2 transport at EU-level. The CCS Directive is mostly focused on CO2 storage and does not provide sufficient detail on critical regulatory elements for multi-mode CO2 transport. In order for CCUS deployment to take place at a European level, transnational transport of CO2 will be needed. Thus, there is a need to provide guidance and harmonisation to ensure interoperability across member states.

- Finally, member states should be required to clearly declare the planned role of CCUS in the next revision of their National Energy and Climate Action Plans and long-term climate strategies, identifying domestic capture, transport, use and storage development or CO2 export objectives, and concrete measures to achieve them.

Funding for CCUS projects

Overview of funding opportunities at EU level

At the moment, there is important financial support available for CCUS initiatives, encouraging their development and commercial deployment across the EU. Key funding mechanisms include the EU’s ETS Innovation Fund, the Climate Energy and Environment State Aid Guidelines, and the Connecting Europe Facility (CEF) under the TEN-E Regulation (Trans-European Networks for Energy).

ETS Innovation Fund

As regards the EU’s ETS Innovation Fund, this represents a significant funding opportunity for CCUS projects in Europe. It aims to support the development of innovative low-carbon technologies, including CCUS. It should be noted that the Innovation Fund aims to allocate over €38 billion towards low-carbon technologies by 2030. As part of this amount, the Commission will invest €3 billion towards 17 large scale innovative clean tech projects, including carbon capture and storage efforts. This funding is dedicated to projects that can demonstrate a significant potential for reducing GHG emissions. The fund provides financial assistance for the construction and operation of CCUS facilities, including carbon capture, transport and storage infrastructure. However, funding from the ETS Innovation Fund will only be able to cover a limited portion of necessary investment (by design, it is intended to fund demonstration/pilot projects rather than production capacity).

The Commission has started awarding serious funding amounts to CCS-related projects under the EU Innovation Fund. To date, a total of 11 projects with a CCS or CCU component have received funding through the EU Innovation Fund, while a third call for large-scale projects was launched in November 2022, with the award of the grants to be published during Q4 2023. The CCS and CCU projects so far selected are located in, inter alia, Bulgaria, Iceland, Poland, France, Sweden and Germany, with projects ranging from low-carbon cement production, carbon mineral storage site development and sustainable aviation fuel production.

Climate energy and environment state aid guidelines

In addition, revised State Aid Guidelines [10] aim to support the EU's climate and energy objectives. Among other things, these guidelines focus on facilitating investment in CCUS projects while ensuring fair competition and environmental sustainability.

Key highlights include:

- Aid for the production of renewable energy and storage.

- Investment aid by member states may take the form of direct grants, repayable advances, loans, guarantees or tax advantages notably tax credits (inspired by the investment tax credits that is the basic aid vehicle in the US’s Inflation Reduction Act IRA).

- Operating aid must be granted in the form of two-way contracts for difference via tenders. The guidelines propose the use of Carbon Contracts for Difference (CCfDs) as a funding mechanism for CCUS projects. CCfDs provide a long-term guarantee for the sale of captured CO2, helping to address the financial risks associated with CCUS deployment.

- Aid for ‘strategic net-zero sectors’ concerns sectors, such as solar panels, wind turbines, heat-pumps, electrolysers and CCUS (as well as related key components and critical raw materials).

- Finally, the guidelines emphasise the importance of environmental sustainability and require CCUS projects to meet strict criteria related to CO2 storage safety, monitoring and reporting.

Trans-European networks for energy and connecting Europe facility

The revised Trans-European Networks for Energy (TEN-E) [11] framework enables the inclusion of both CO2 storage and transport projects including dedicated pipelines for CO2 transport and fixed facilities for liquefaction, buffer storage and converters of carbon dioxide in view of its further transportation through pipelines and in dedicated modes of transport such as ship, barge, truck, and train. This provides a legislative framework for identifying ‘Projects of Common Interest’ (PCI), which are essentially energy infrastructure projects that are then given priority status by member states, and which can attract EU funding from the Connecting Europe Facility (CEF). CCS infrastructure, such as CO2 transport networks and storage facilities, can be designated as PCIs, making them eligible for funding under the Connecting Europe Facility programme for 2021-2027 [12], which allocates a total budget of €5,8 billion to the energy sector. In respect to eligibility, CCUS projects seeking CEF funding must demonstrate their contribution to the EU's energy policy goals, including decarbonisation and security of supply. They should further align with the objectives outlined in the TEN-E regulation, promoting cross-border cooperation and integration of the internal energy market.

Financial incentives at national level

Measures to stimulate investment in CCUS projects are not only required at EU level but also needed at member states level. Certain key strategies may include subsidies by member states in the form of investment and/or operational subsidies.

Investment subsidies

Governments can offer direct investment subsidies to incentivise CCUS. By providing financial support for infrastructure development, construction costs and operational expenses, these subsidies reduce the financial burden and increase the attractiveness of investing in CCUS.

For example, Germany's Energy and Climate Fund provides significant financial support for CCS projects. With a budget of €300 million, the fund aims to encourage the development of innovative CCS technologies and infrastructure.

Operational subsidies

- Long-term contracts: Governments can introduce operational subsidies such as long-term contracts that guarantee a minimum price for the sale of captured CO2. These subsidies mitigate revenue risks and improve the economic viability of CCUS investments. In this context, the Netherlands implemented the SDE++ subsidy scheme which offers CCS projects long-term contracts for the sale of CO2 at a guaranteed price. This provides investors with revenue stability, attracting capital and reducing financial uncertainties. The SDE++ subsidy from the Dutch government provides a Carbon contract for Difference (CCfD)-like subsidy to support the cost of CCUS operations, that is, the subsidy will cover the cost of the project above the EU ETS price but will only run until 2035 as CCUS is considered a transitionary technology.

- Contracts for Difference: CfDs can enhance investment in CCUS projects by reducing financial risks. It is a key mechanism to support early-mover projects by allowing them to reach deployment by covering the uncommercial costs. A financial CfD is a legally binding agreement between an investor and the competent office/institution designated by the Member State, in which the difference between the price of an underlying asset at the start of the contract and the price when the contract is closed is guaranteed. In the context of CCUS, this refers to a guaranteed price for capturing CO2 in relation to the ETS price.

CfDs allow for investor assurance that when the allowance falls below a pre-agreed strike price, the CfD will be triggered and make up the shortfall. The strike price will differ between and within industrial sectors given the varying costs. The strike price can be established by auction, pre-agreed by the investor and the designated office/institution on the basis of the expected development of the ETS price or simply fixed by the designated office/institution, for instance as a fixed feed-in tariff.

For example, a strike price of €80 per tonne of CO2 was recently allocated to the emitters supplying CO2 to a large-scale CCS project in the Netherlands (Porthos). Germany established a CfD for CCS projects by introducing a fixed feed-in tariff for the sale of captured CO2 over a specific period, attracting long-term investments and promoting the economic feasibility of CCS initiatives.

Upfront investment and state guarantees: Governments can facilitate investment in CCUS projects by providing upfront capital and state guarantees. These measures enhance investor confidence and alleviate financial risks associated with large-scale CCUS deployment.

The Netherlands has implemented state guarantees within the SDE++ subsidy scheme, covering a portion of upfront investment costs. This significantly reduces the financial burden of investors, making, in parallel, CCS projects more attractive for private capital.

Outlook

The need for CCS in the International Energy Agency’s (IEA) Sustainable Development Scenario translates to an estimated 70-100 CCS facilities built per annum, for which the total capital requirement is estimated to be internationally between $655 bn and $1280 bn. The IEA forecasts that $205 bn is needed annually by 2030 to be invested in CCS development for the world to stay on track to reach net-zero emissions by 2050. For the EU it is expected that more than $30 bn is needed to be invested in CCS by 2030. To achieve this, the private sector must be incentivised to invest in CCS. This means most of the funding for CCS is to come from debt, capital markets, and other sources such as sovereign wealth funds, which currently do not directly fund CCS on a meaningful scale. It is highly questionable whether the public financing options are sufficient to trigger the missing private and commercial investments in CCUS projects. According to Bloomberg New Energy Finance, the global investment in CCS fell slightly to $2.3 bn in 2021 which increases, rather than closes, the gap between the capital requirements and the readiness of the private and commercial sector to invest in the CCUS technology.

Conclusions

There is a growing conviction that CCUS as a decarbonisation technology will be necessary, if not indispensable, to achieve EU's climate objectives. Only recently have political and economic reasons pushed CCUS to the forefront and the EU has now set certain key economic drivers and policy frameworks to create the necessary certainty for investors aiming to promote the deployment of CCUS. Next steps will be the issuing of a CCUS Strategy by the Commission that will, along with other measures, set a road map for the development of CO2 capture, grid infrastructure and storage.

This strategy will most probably also outline the concrete rules and measures for the regulatory framework which might become one of the first legislative initiatives for the new Commission in 2025. It can be expected that the Commission will closely follow the recommendations for the future regulatory framework for CCUS which are put forward by the CCUS Forum that was created by the Commission for this purpose and in which the Commission itself played an active part.

The communication on the CCUS strategy is expected to be announced at the end of 2023 and will then be followed up by concrete legal proposals under the new Commission in 2025. There is also a common understanding that the huge investment costs need to be partially covered by public support at EU and member states level in order to leverage the necessary private investment. The support mechanisms already available at both levels are widespread and the amounts foreseen for CCUS projects are considerable.

At EU level it is first and foremost the ETS Innovation Fund which already, and also in future, will be instrumental for the financing of CCS projects; at national level the Dutch and German schemes are important but are not yet sufficient to provide the necessary incentives to invest at large scale into CCUS projects. Therefore, at the moment, the huge investment needs seem not to be sufficiently covered by the available public and expected private investment.

References

[1] EU CCUS Vision Working Group (2023). ‘A Vision for Carbon Capture, Utilisation and Storage in the EU’, May 2023.

[2] IPCC 6th Assessment Report (2022). ‘Climate Change 2022, Mitigation of Climate Change – Summary for Policymakers’, p.28

[3] https://ariadneprojekt.de/media/2023/01/AriadneDocumentation_ETSWorksho…

[4] Directive (EU) 2023/959 of the European Parliament and of the Council of 10 May 2023 amending Directive 2003/87/EC establishing a system for greenhouse gas emission allowance trading within the Union Decision (EU) 2015/1814 concerning the establishment and operation of a market stability reserve for the Union greenhouse gas emission trading scheme and Regulation (EU) 2015/757

[5] Regulation (EU) 2023/956 of the European Parliament and of the Council of 10 May 2023 establishing a carbon border adjustment mechanism, OJ 2023 L 130/52

[6] See Proposal for a Directive of the European Parliament and of the Council of 23.2.2022 on Corporate Sustainability Due Diligence and amending Directive (EU) 2019/1937, COM (2022) 71 final

[7] Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 on the establishment of a framework to facilitate sustainable investment, and amending Regulation (EU) 2019/2088, OJ L 198/13; Commission Delegated Regulation (EU) 2021/2139 of 4 June 2021 supplementing Regulation (EU) 2020/852 of the European Parliament and of the Council by establishing the technical screening criteria for determining the conditions under which an economic activity qualifies as contributing substantially to climate change mitigation or climate change adaptation and for determining whether that economic activity causes no significant harm to any of the other environmental objectives, L 442

[8] Commission Proposal for a regulation of the European Parliament and of the Council on establishing a framework of measures for strengthening Europe’s net-zero technology products manufacturing ecosystem (Net Zero Industry Act) COM (2023) 161

[9] See Directive 2009/31/EC of the European Parliament and of the Council of 23 April 2009 on the geological storage of carbon dioxide and amending Council Directive 85/337/EEC, European Parliament and Council Directives 2000/60/EC, 2001/80/EC, 2004/35/EC, 2006/12/EC, 2008/1/EC and Regulation (EC) No 1013/2006 (CCS Directive), OJ L 140/14–135

[10] Commission Communication on the Temporary Crisis and Transition Framework for State Aid measures to support the economy following the aggression against Ukraine by Russia, C/2023/1711

[11] Regulation (EU) 2022/869 of the European Parliament and of the Council of 30 May 2022 on guidelines for trans-European energy infrastructure, amending Regulations (EC) No 715/2009, (EU) 2019/942 and (EU) 2019/943 and Directives 2009/73/EC and (EU) 2019/944, and repealing Regulation (EU) No 347/2013, OJ L 152/45–102

[12] Regulation (EU) 2021/1153 of the European Parliament and of the Council of 7 July 2021 establishing the Connecting Europe Facility and repealing Regulations (EU) No 1316/2013 and (EU) No 283/2014, OJ L 249/38–81.

Send your comments to rogerl@nowmedia.co.za.